July 20, 2021

Protect Your Cryptocurrency with a VPN

Research suggests that global crypto trading grew to 106 million users in January 2021, [...]

WHAT’S IN THIS REVIEW?

Disclaimer: Partnerships & affiliate links help us create better content. Learn how.

We saw the biggest digital transactions spike in 2020. Yet, the writing was already on the wall for how people spent money well before COVID-19 disrupted our lives. The concept of a digital payment method actually popped up more than 20 years ago, though thanks to lockdowns, this cashless trend is now in overdrive.

With everything forced to go online last year, people quickly adopted digital methods to pay bills and simply survive. In the U.S. alone, there were over 1.2 billion transactions made using some form of a digital wallet. And you can expect this to grow.

If you’re still lugging around a wad of cash or don’t know which app to choose, this guide is for you. We break down how to use and protect your digital wallet, while also highlighting top apps available today.

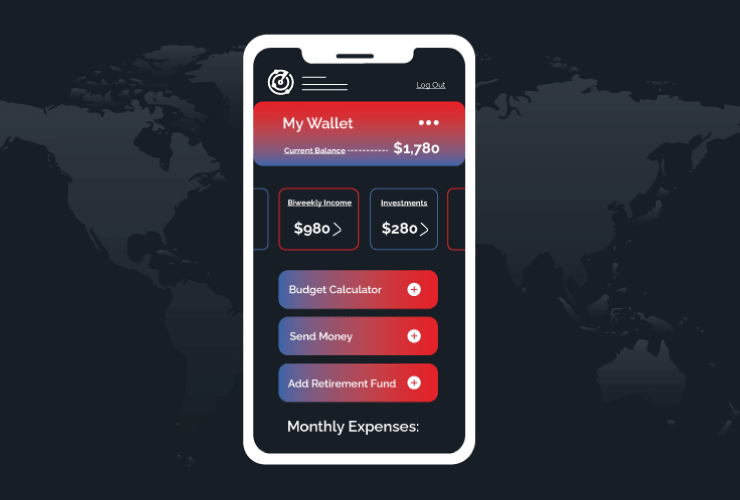

Also known as an “e-Wallet,” a digital wallet is a cloud-based service that enables people to transact online. For example, any website or app you use to make a payment is considered a digital wallet. Able to safely store different payment methods (i.e. credit or debit cards) on things like your smartphone or wearable devices, it ultimately omits the need for a physical wallet.

Rather than having just one, it’s common for individuals to use anywhere from 3-5 different apps at once. We touch on how digital wallets can vary depending on which one you choose in a few sections.

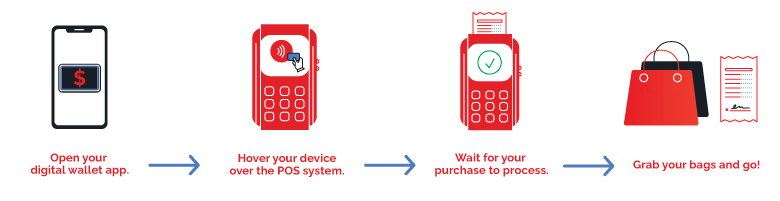

No matter what digital wallet you use, they generally follow the same process to complete purchases. Here’s a simple diagram to illustrate what we mean:

Usually, digital wallets require you to download an app on your smartphone or wearable. You can then use your device at any participating store or website to make purchases. Any retailer that has a point of sale (POS) terminal – think of a card machine at the checkout counter – can accept digital forms of payment.

However, the technology used to complete these transactions are what differ from app to app. Here are the most common mechanisms used by digital wallet issuers:

NFC (near-field communication) is exactly what it sounds like. This reader accepts transactions by using an electromagnetic induction link between the reading terminal and a credit card/device. It’s all about proximity. Once you’re within a few inches of the terminal, your device will send the necessary payment information. Think of Apply Pay for this.

MST (magnetic secure transmission) technology uses “magnetic” signals to basically mimic the connection made by swiping physical credit cards in a machine. The advantage of MST technology is that it works with most NFC-ready terminals. So, retailers don’t have to invest in extra equipment to accept these digital payments. Samsung Pay uses this method.

You can think of digital delivery technology as online payments. Amazon Pay is a good example here. You can make these types of payments on any IoT device, but stores rarely accepted it.

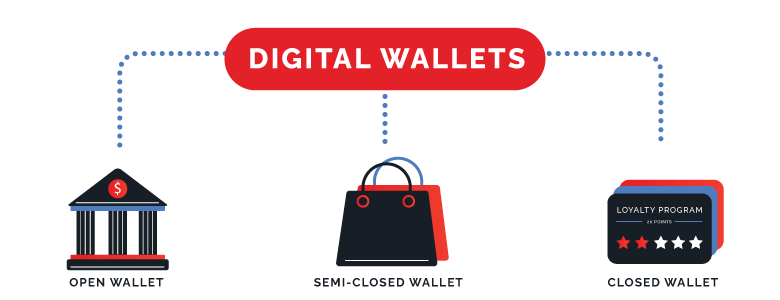

There are three main buckets a digital wallet can fall into based on the transactions it allows:

This is the most common wallet because it offers the greatest flexibility. Only issued by banks, open e-wallets allow users to make in-store and online payments. You can also withdraw cash at banks and ATMs and transfer funds to individual people. Most banks today offer this service, so clients can manage their finances easier. Chase bank is famous for its user-friendly open wallet.

As its name suggests, a semi-open digital wallet isn’t quite as flexible. Users can only make in-store and online payments with businesses that have agreements or contracts with the digital wallet issuer. So, as long as the business or website accepts payments from your specific app, you can send money from your account to theirs in seconds. Apply Pay is a good example of this.

These are more niche than other wallet types. Built for individual companies, closed wallets allow users to spend pre-loaded funds at that specific store. Users can also manage cancellations, returns, and refunds through these digital wallets and join loyalty programs to earn rewards. Walmart Pay recently launched their own closed e-wallet to incentivize easier checkouts.

Digital wallets are proven to be safer, quicker, and more reliable than cash or physical cards. However, it’s important to know the pros and cons before using one. There are always tradeoffs to consider no matter how you deal with money.

Digital wallets come with really neat tools that make it easy for users to manage their money. Here are six useful features we see the best digital wallet apps use today:

This is a key feature of digital wallets that makes them far more secure than having money in your pocket. Biometric authorization adds an extra layer of security to your financial accounts and limits the risk of data fraud. These money apps store highly sensitive information, and as such, users require reassurances. Biometric logins may include fingerprint recognition, facial recognition, or retina scans to verify correct users.

Some eCommerce stores will have agreements with semi-closed wallet issuers (like Amazon Pay or PayPal) that allow individuals to use their digital wallets to complete an online purchase. This is both quicker and safer than manually entering your credit card information on a site.

If there’s one app on your phone you should keep push notifications on for, it’s your digital wallet. This feature is a great way to stay updated on any new offers run by the app. Even better, it helps users keep track of purchases made from their accounts. You’ll get a notification each time a transaction is made on your account.

The best digital wallets include this feature to make transactions between people even smoother. It’s a unique and scannable code you can share account details through. Rather than manually entering in your information to receive or send a payment, a QR code redirects you to a payment page with both parties loaded.

A byproduct of digital wallets, companies will sometimes offer loyalty programs that allow customers to earn rewards they can use on their services or products. Starbucks is notorious for its Star Program where customers are able to trade in “stars” for free drinks and merchandise after spending a certain amount of money.

The greenest feature of them all, digital receipts are a big benefit of digital wallets. Stored on your app or online account, digital receipts help users waste less paper, keep track of purchases, and manage overall finances better.

There are thousands of digital wallets to choose from, and each one serves a unique purpose. It’s pretty common for users to have anywhere from 3-5 services. For example, I personally use Apple Pay, Venmo, and Exodus but all for different reasons. Check out the most popular digital wallets and what they’re best used for below.

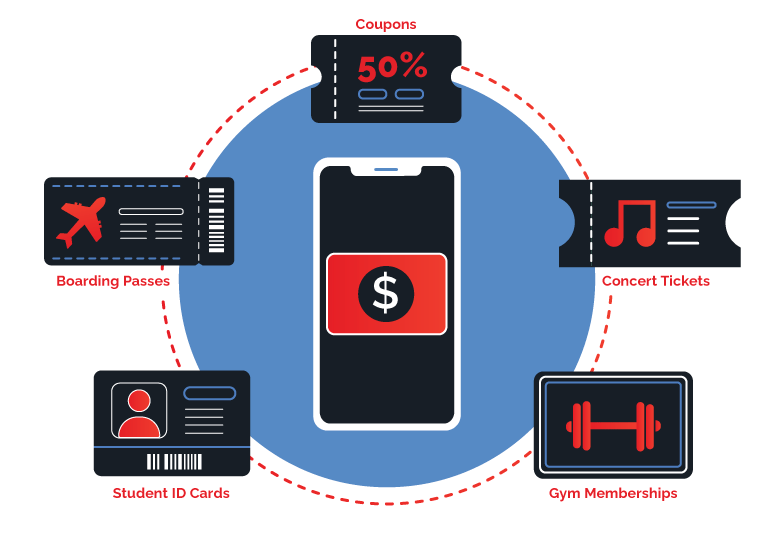

In addition to credit and debit cards, digital wallets can also store:

Keep in mind that e-wallets can get cluttered, too. Be sure to “clean out” yours every few months to keep it organized.

Digital wallets are inherently safe, yet there are always risks involved when you deal with money. Here are additional steps we recommend taking to ensure your financial information remains protected.

As you can see, digital wallets have proven to be very efficient. And with retailers accepting these new payment methods, usage is no longer confined to online shopping. If you haven’t tried one out yet, we think it’s only a matter of time.

Digital wallets allow you to earn rewards, check out quicker, and rest easier knowing your money is secure. No more fumbling for cards at checkout. Swap out the swipes and chip-inserts for a safer way to checkout.

WHAT’S IN THIS REVIEW?

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFlare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 1 year | This cookies is set by GDPR Cookie Consent WordPress Plugin. The cookie is used to remember the user consent for the cookies under the category "Analytics". |

| cookielawinfo-checkbox-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-non-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Non-necessary". |

| cookielawinfo-checkbox-performance | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 1 year | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-functional | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-others | 1 year | No description |