May 28, 2022

How to Save Money on Streaming Services With a VPN

Premium VPNs are commonly used to protect users’ online privacy, but did you know they can also [...]

WHAT’S IN THIS REVIEW?

Disclaimer: Partnerships & affiliate links help us create better content. Learn how.

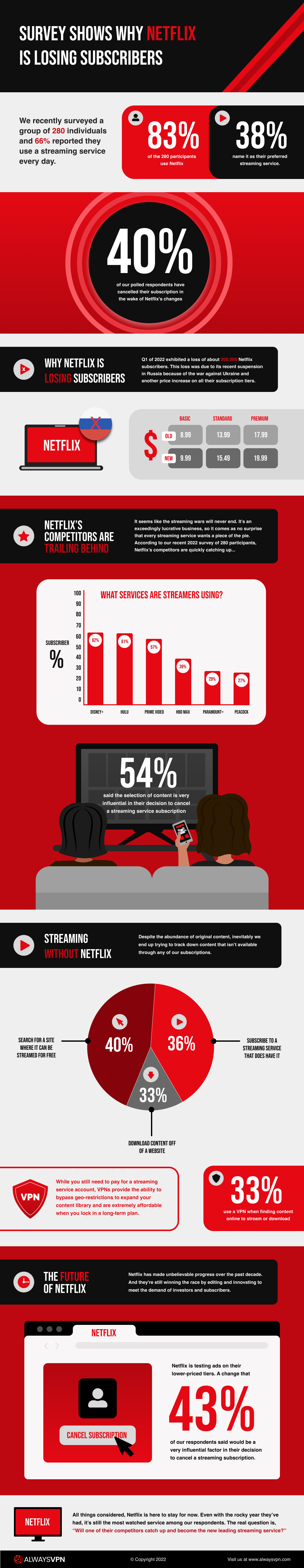

We recently surveyed a group of 280 individuals and 66% reported they use a streaming service every day. But even with many tuning in on a daily basis, the state of streaming is rapidly changing to fit the growing needs of streaming services and their subscribers.

Unfortunately for Netflix, nearly 40% of our respondents say they’ve called it quits in the wake of Netflix’s many recent shifts.

Streaming services saw a rise in 2020, during the height of the COVID-19 pandemic when most were isolated in their homes and one of the few means to be entertained was streaming. During this year subscriptions surpassed 1 billion worldwide. The post-pandemic phase is a different story though.

With today’s economy inflating the costs of food, housing, and gas, many people are cutting their expenses. And subscription services like Netflix are some of the first few costs people are axing from their budget. Our respondents said price increases, blocks on account sharing, and content preferences were their biggest deal-breakers.

Given the massive amount of money Netflix is pouring into original content, this could spell trouble. This guide encompasses the current position of Netflix, its subscribers, and what the future may hold for both.

Netflix has been through an incredible journey since it was founded in 1997. They started with DVD rental distribution, introduced a no-late fee subscription model, and acquired over 6 million subscribers by 2006. By then, they were full steam ahead and worked up as a profitable company and started to offer streaming content to Canada.

Soon after, Netflix streaming became available to US users and a shift in the entertainment world was upon us. In 2012, Netflix started to invest millions of dollars to create original content and built an impressive library of almost any genre you can think of. Today, you can find anything from comedies to romance and anime to documentaries.

PRO TIP: Many of what Netflix has to offer is blocked due to geo-restrictions. Use a VPN for streaming to access content available outside your country.

Fast forward 9 years to 2021, Netflix becomes available in over 190 countries worldwide and surpasses 209 million subscribers—and is recognized as the most popular streaming service. Our recent survey shows that 83% of the 280 participants use Netflix and yet only 39% name it as their preferred streaming service. Why is Netflix losing its standing in 2022?

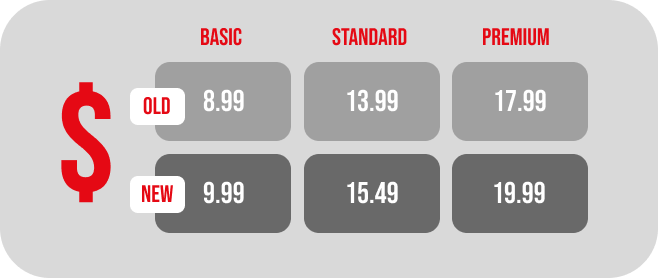

Q1 of 2022 exhibited a loss of about 200,000 Netflix subscribers. This loss was due to its recent suspension in Russia because of the war against Ukraine and another round of price increases (see below) on all their subscription tiers. Changes to price is one of the leading factors to influence a streaming service cancelation by 30% of survey respondents.

The survey we conducted discovered that 39% of participants who have canceled a streaming service chose Netflix to axe. Changes to fees, selection of content, preference for another streaming service, and scaling down the number of subscriptions were the top and most influential factors in their decision to cancel.

A whopping 72% of subscribed respondents said that their Netflix subscription fee has increased in the time that they’ve been streaming. Compared to the 34% that said Hulu, and 27% that cited Disney+, it’s clear why many have chosen Netflix as the first to go.

Even though Netflix’s subscriber base remains in the millions, this rough patch is a notable loss and ignites a fire in them to make some serious changes. Especially when they need a return on the billions they’re spending on original content and other streaming services saturating the market at an insatiable rate.

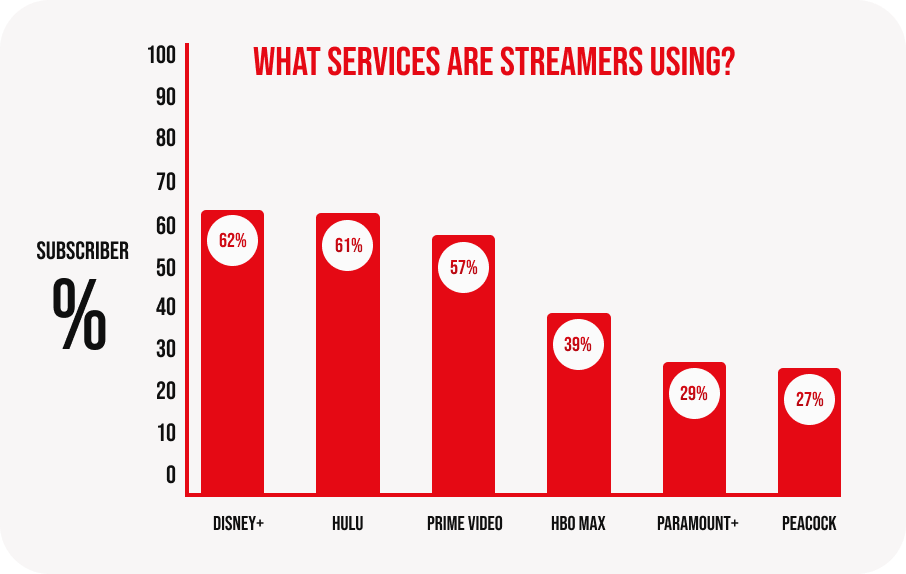

It seems like the streaming wars will never end. It’s an exceedingly lucrative business, so it comes as no surprise that every streaming service wants a piece of the pie. Netflix’s competitors are quickly catching up with 62% of respondents using Disney+, 61% using Hulu, 57% using Prime Video, 39% using HBO Max, 29% using Paramount+, and 27% using Peacock.

54% said the selection of content is very influential in their decision to cancel a streaming service subscription. It’s understandable then why Netflix and its competitors throw in insane amounts of money for the rights to stream exclusive content and produce originals. Content libraries will continue to grow to meet the demands of streaming enthusiasts.

In particular, Disney+ is taking notes from Netflix’s book and exponentially growing throughout 2022. In Q1, they had a more favorable quarter compared to Netflix and acquired about 7.9 million subscribers—giving Disney+ a subscriber total of around 87.6 million. Their content is winning the hearts of millions and it’s becoming even tougher to deny its nostalgic enchantment with Disney classics, Star Wars continuations, and Marvel creations.

Although it’s worth noting, Netflix still owns the biggest piece of the pie with over 220 million subscribers. Sure, they’re available in more countries than any other streaming service but as competitors become more popular and also expand reach, that all may change.

When it comes to cancelations, users are also cutting ties with Netflix’s competitors. Our survey showed that 29% of respondents canceled Hulu, 24% canceled HBO Max, 22% canceled Disney+, 17% canceled Paramount+, 17% canceled Peacock, and 15% canceled Prime Video. Inevitably, account cancelations are always going to fluctuate for streaming services. To retain the majority of streaming enthusiasts, streaming services need to offer a favorable balance between fees and exclusive content. The real question is, “Is that even possible with the current state of demand and inflation?”

Despite the abundance of original content, we inevitably try to track down content that isn’t available in any of our subscriptions. We asked our survey participants how they stream content unavailable on the streaming service(s) they subscribe to—and 40% said they search for a site where it can be streamed for free. 33% said in order to do this, they use a VPN.

40% said they search for a site where it can be streamed for free and 33% said in order to do this, they use a VPN.

Another way is to sign up for a new streaming service to watch content. This is probably the easiest option to get a high-quality stream—in fact, 36% of respondents say that’s what they do—but this only adds dollars to your monthly bills. Using a VPN or finding a site to stream for free may take a little more effort upfront but for fewer to zero dollars.

VPNs are extremely affordable when you lock in a long-term plan and can cost less than a quarter of what you would pay for Netflix. Yes, you still need to pay for an account but a VPN provides the ability to bypass geo-restrictions and opens the portal to international entertainment. Do this by changing your Netflix region to access unique content libraries that are normally unavailable in your country.

Finding a site to stream content for free is certainly a viable option. But, this route typically involves ads, illegal activity, or poor quality. Freemium streaming tiers include ads throughout a stream, which is unappealing, and why streaming services monetize on subscription tiers without ads. The 40% of respondents that hunt for a site to stream for free are most likely accessing illegal content and/or dealing with a faulty stream from a torrenting site. Downloading torrents is becoming more prevalent with streaming services upping their prices. The caveat is internet providers frown upon this so it’s vital to use a VPN for torrenting. This will keep your activity private and secure from your internet provider.

The truth is VPNs and torrenting sites make streaming more accessible. Over a quarter of our respondents said they already default to these alternatives over using a streaming service. However, Netflix and its competitors are cracking down on these workarounds—and will stop at nothing to uphold their coveted entertainment statuses.

The streaming world has made unbelievable progress over the past decade. And Netflix is still winning the race by editing and innovating its platform to reach the demand of investors and subscribers. This—as one would expect—includes price increases, algorithm updates, features to personalize a user’s experience, original content, and pursuing global expansion. All these changes are landing Netflix in the headlines and stirring up controversy.

In recent news, Netflix announced they’re testing out ads in their lower-priced tiers—a move that 43% of respondents said would be a very influential factor in their decision to cancel a streaming subscription.

43% of respondents say ‘adding ads’ would be a very influential factor to canceling a streaming service.

And in other news, Netflix began to test a feature in a few countries that require users to add extra viewers (people outside your home) for an additional cost. 32% of the participants surveyed said it would be unlikely that they would continue subscribing if this was implemented globally. Out of the 280, 52% said they share their streaming service credentials with other people. So, this new feature may continue to hurt their numbers. On top of that, they have promised to carry on with immense releases of original content. This could also be risky in the future with the billions of dollars it requires to produce originals at their rate.

All things considered, Netflix is here to stay for now. Even with the rocky year they’ve had, it’s still the most-watched service among our respondents. The real question is, “Will one of their competitors catch up and become the new leading streaming service?”

To gain insight into the scope of Netflix’s current state, AlwaysVPN conducted a public survey in June 2022. Respondents are based in the US and—to participate in the survey—are required to use a streaming service to stream content. We received a total of 280 participants.

Our goal is to understand why Netflix has been struggling to retain subscribers throughout Q1 and Q2 of 2022—and, based on the results, predict what the future holds for Netflix. The survey respondents were asked a series of 28 questions. Through this, we compiled qualitative and quantitative data from their responses, analyzed the statistical numbers, and categorized the open-ended results—all to explore our theoretical perspective to support the explanation of Netflix’s current state.

WHAT’S IN THIS REVIEW?

Based on server networks, speed, and ability to bypass geo-blocks, we found to best VPNs for Netflix—just for you.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFlare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 1 year | This cookies is set by GDPR Cookie Consent WordPress Plugin. The cookie is used to remember the user consent for the cookies under the category "Analytics". |

| cookielawinfo-checkbox-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-non-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Non-necessary". |

| cookielawinfo-checkbox-performance | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 1 year | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-functional | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-others | 1 year | No description |